The Federal Board of Revenue has launched a sweeping enforcement drive targeting doctors and medical practitioners after uncovering widespread tax non-compliance within the sector. According to official data, tens of thousands of high-earning doctors across Pakistan are either not filing income tax returns or significantly under-reporting their earnings, raising serious concerns about equity and compliance in the tax system.

FBR officials revealed that out of 130,243 registered doctors nationwide, only 56,287 filed income tax returns for the current tax year. This means more than 73,000 registered medical professionals did not submit any return at all, despite working in one of the country’s most lucrative professions. Authorities described the findings as alarming and indicative of a deep-rooted compliance crisis.

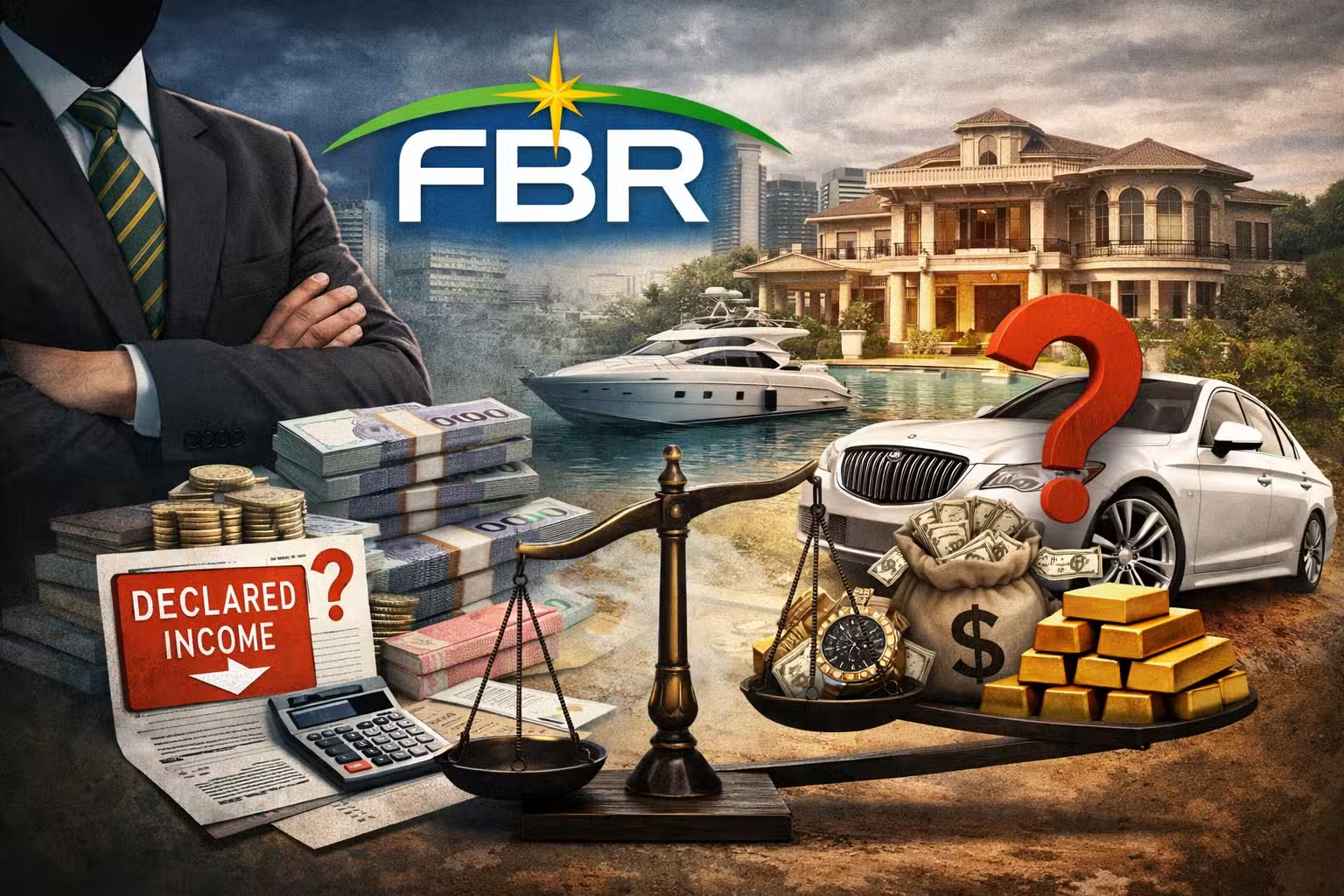

The data further highlights discrepancies between reported incomes and the visible scale of private medical practices. Nearly 31,870 doctors declared zero income from private practice in 2025, while another 307 reported losses, even though many operate busy clinics in major urban centers. Only 24,137 doctors acknowledged earning any business income, a figure officials say does not align with ground realities.

Even among those who did file returns, declared tax contributions appear disproportionately low. Doctors with annual receipts exceeding Rs. 1 million reportedly paid an average of Rs. 1,894 per day in taxes. Those earning between Rs. 1 million and Rs. 5 million paid just Rs. 1,094 per day, while practitioners in the Rs. 5–10 million bracket paid an average of Rs. 1,594 per day.

The numbers become more striking at the higher end. The top 3,327 earners, each reporting receipts above Rs. 10 million annually, paid an average of only Rs. 5,500 per day in taxes. In contrast, 38,761 doctors declaring receipts below Rs. 1 million paid Rs. 791 per day on average. Meanwhile, more than 31,500 doctors reported zero receipts yet collectively claimed tax refunds totaling Rs. 1.3 billion.

Officials pointed out that many doctors charge consultation fees ranging from Rs. 2,000 to Rs. 10,000 per patient, yet their declared daily tax payments are often lower than the fee from a single consultation. This disparity stands in sharp contrast to salaried government employees in Grade 17 and 18, who often pay higher monthly taxes despite earning significantly less and having no flexibility to conceal income.

FBR officials stressed that reliance on a narrow base of salaried taxpayers is no longer sustainable. They warned that tax compliance among high-income professions is not optional and that enforcement measures will be intensified to ensure fairness and accountability in the system.